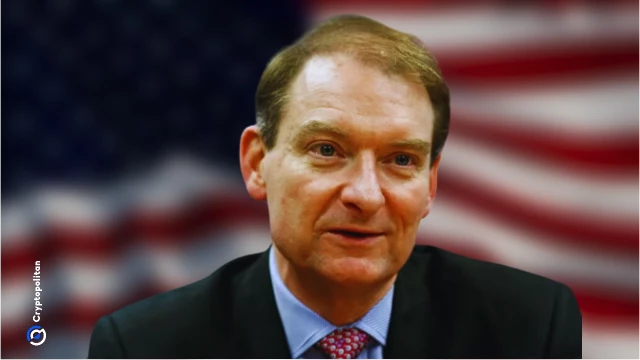

SEC chair Paul Atkins says most crypto tokens aren't securities under new standards

Cryptopolitangeneral

The US Securities and Exchange Commission (SEC) chairman, Paul Atkins, has cleared the air on what has been the industry's sore point for years, especially under Gary Gensler.

📋 Article Summary

In a significant development, SEC Chairman Paul Atkins has provided much-needed clarity on the regulatory treatment of cryptocurrencies, potentially easing the long-standing uncertainty that has plagued the industry.

Atkins' comments come at a crucial juncture, as the SEC, under the leadership of Gary Gensler, has taken a more aggressive stance on classifying various digital assets as securities. This has led to an ongoing debate and legal battles, with the industry seeking more definitive guidance on the regulatory framework.

Atkins' statement suggests a more nuanced approach, indicating that the majority of cryptocurrency tokens may not be considered securities under the SEC's new standards. This is a significant shift from the previous stance, which had raised concerns about the broad application of securities laws to the crypto sector.

The implications of this announcement are far-reaching. By providing a clearer regulatory path for cryptocurrencies, it could pave the way for increased institutional adoption and investor confidence in the market. This, in turn, could drive further innovation and growth within the industry, as entrepreneurs and developers have a better understanding of the regulatory landscape.

Moreover, this move aligns with the broader trend of regulatory bodies around the world seeking to strike a balance between fostering innovation and maintaining investor protection. As the crypto ecosystem continues to evolve, regulators are recognizing the need for more nuanced and flexible approaches to accommodate the unique characteristics of digital assets.

Experts in the industry have widely welcomed Atkins' comments, viewing them as a positive step towards creating a more favorable regulatory environment for the crypto sector. This could potentially pave the way for increased institutional investment, as well as the development of new cryptocurrency-based products and services that cater to a wider range of investors.

However, it's important to note that the regulatory landscape remains complex and fluid. The SEC and other regulatory bodies will likely continue to scrutinize the crypto industry, and specific token classifications may still be subject to case-by-case analysis. Nonetheless, Atkins' remarks represent a significant shift in the regulatory approach, which could have far-reaching implications for the future of the cryptocurrency market.

As the crypto ecosystem continues to evolve, the industry will closely monitor the SEC's actions and any further clarification or guidance provided by regulatory authorities. This development is a positive step towards creating a more conducive environment for the growth and mainstream adoption of cryptocurrencies, ultimately benefiting both investors and the broader industry.