Investigative Reporter Group ICIJ Exposes ‘Coin Laundry,' Crypto's Criminal Financial System

📋 Article Summary

Related Articles

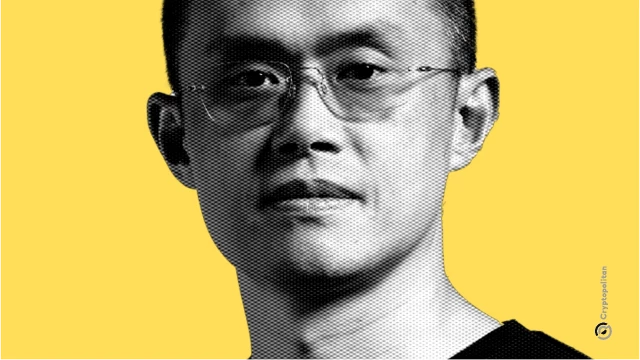

Binance could return to U.S. expansion if $4.3 billion fine is reversed, CZ says

Binance's founder Changpeng 'CZ' Zhao hinted that if the exchange's $4.3B fine in the USA is reversed, the money would be used for investments in the USA.

Unregistered Crypto Firms in Canada Fueling Million-Dollar Money Laundering

An undercover investigation reveals how unregistered crypto-to-cash operators across Canada process transactions up to $1 million with zero identity verification, exposing enforcement gaps that experts warn enable unlimited criminal activity.

Stablecoins could force ECB to rethink monetary policy, key official warns

Stablecoins could pose a risk to financial stability and inflation in Europe that could compel the European Central Bank to reconsider its monetary policy, according to Dutch central bank governor Olaf Sleijpen.

Crypto funds log sharpest weekly exits since February amid macro jitters: CoinShares

Crypto products have posted their largest weekly outflows since February, with $2 billion exiting ETPs as policy uncertainty weighs on sentiment.

Insider: Banks Prepared to Offer Crypto Services in Argentina

Gabriel Campa, Head of Digital Assets at Towerbank, stated that he believes Argentine banks are ready to enter the cryptocurrency services market. He highlighted that many have already finalized software for this end, and are waiting to be greenlighted by regulators.

Crypto Slide Driven by Leverage, Bottom May Be Near

Analysts say crypto's decline reflects market mechanics more than fundamentals, hinting the sell-off may be nearing its end.