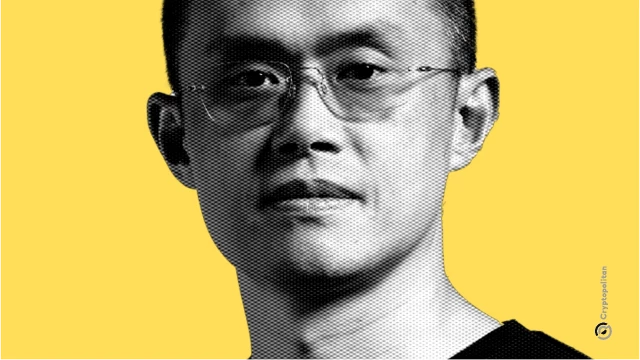

Binance could return to U.S. expansion if $4.3 billion fine is reversed, CZ says

📋 Article Summary

Related Articles

Crypto Bros Turn Bill Ackman's Old-School Charm Into a New Trend

TL;DR Billionaire Bill Ackman shared a tactic from his youth: asking “May I meet you?”. A “Crypto X” creator, Nick O'Neill, tested the method on the New York subway, with little success. The community was divided between humor and criticism, noting the advice is disconnected from reality.

Japan to Reclassify Crypto as Financial Products, Paving Way for Tax Relief

Japan's Financial Services Agency (FSA) confirmed through local reporting that it is advancing plans to reclassify major crypto assets as financial products, with a formal proposal expected during the 2026 ordinary Diet session. The agency also signaled its intention to introduce tax relief for crypto gains, aligning them with Japan's stock investment tax rate.

Digital asset products see billions in outflows amid volatility

Digital asset investment products recorded $2 billion in outflows last week, marking the heaviest weekly withdrawals since February, according to industry data. The outflows extended a three-week decline to $3.

Ant International, UBS Team Up for Blockchain Payments Across Borders

Ant International has partnered with UBS to integrate blockchain‑based digital cash and explore tokenized deposits.

New Report Finds Chinese Money Launderers Turning to Crypto Tools

Kathryn Westmore, a senior research fellow at the Centre for Finance and Security, stated today that Chinese-linked money-laundering groups are “increasingly integrating crypto rails” into their operations, according to a newly published report.

a16z backs ecosystem-specific 'arcade tokens' to power ecosystem growth without speculation

a16z argues that ecosystem-locked tokens, dubbed “arcade tokens,” could be pivotal in building stable, spendable digital economies. The firm suggested that these tokens, akin to airline miles or credit card points, provide crypto networks with utility that can grow without depending on speculation.