Crypto Fear Index Hits 10, Lowest Since July 2022 — What Happens Next?

📋 Article Summary

Related Articles

Arthur Hayes Is Dumping His Crypto Stash, and Fast

Hayes has dumped over $7.42 million in crypto over the weekend, but with his bad Ethereum trading track record, many traders now expect a rally.

UBS and Ant bet on blockchain to break bottleneck in global treasury flows

UBS and Ant International will test tokenized deposits for real-time cross-border payments and liquidity management in one of Singapore's largest blockchain pilots.

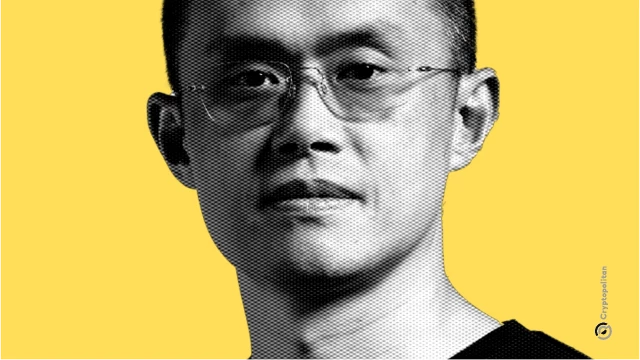

Binance could return to U.S. expansion if $4.3 billion fine is reversed, CZ says

Binance's founder Changpeng 'CZ' Zhao hinted that if the exchange's $4.3B fine in the USA is reversed, the money would be used for investments in the USA.

Unregistered Crypto Firms in Canada Fueling Million-Dollar Money Laundering

An undercover investigation reveals how unregistered crypto-to-cash operators across Canada process transactions up to $1 million with zero identity verification, exposing enforcement gaps that experts warn enable unlimited criminal activity.

Stablecoins could force ECB to rethink monetary policy, key official warns

Stablecoins could pose a risk to financial stability and inflation in Europe that could compel the European Central Bank to reconsider its monetary policy, according to Dutch central bank governor Olaf Sleijpen.

Crypto funds log sharpest weekly exits since February amid macro jitters: CoinShares

Crypto products have posted their largest weekly outflows since February, with $2 billion exiting ETPs as policy uncertainty weighs on sentiment.