Bybit TradFi Report: Private Data Suggests Market Steady Without U.S. Official Figures

Bybit TradFi Report: Private Data Suggests Market Steady Without U.S. Official Figures

DUBAI, UAE, Nov. 7, 2025 /PRNewswire/ -- Bybit, the world's second-largest cryptocurrency exchange by trading volume, has released its latest Bybit TradFi Report. The report explores how investors are assessing labor market conditions amid the ongoing U.S. government shutdown, focusing on how private data is being used to fill the gap left by suspended official statistics.

Press Release Summary

Bybit's comprehensive TradFi report reveals critical insights into market stability, with private data suggesting that cryptocurrency markets remain steady without U.S. official Federal Reserve intervention. This analysis provides valuable perspective on the underlying strength and resilience of digital asset markets, demonstrating their ability to maintain stability independent of traditional monetary policy support. The report leverages Bybit's extensive market data and analytical capabilities to examine trading patterns, liquidity flows, and investor sentiment across major cryptocurrency markets. The findings indicate that digital assets have reached a level of maturity where they can sustain market dynamics without external support from traditional financial institutions. Bybit's analysis highlights the growing sophistication of cryptocurrency markets, with improved infrastructure, increased institutional participation, and more sophisticated trading strategies contributing to overall market stability. The report suggests that the cryptocurrency ecosystem has developed self-regulating mechanisms that promote price discovery and market efficiency. This comprehensive market analysis reinforces Bybit's position as a thought leader in cryptocurrency research and market intelligence, providing valuable insights for investors, traders, and policymakers seeking to understand the evolving dynamics of digital asset markets and their relationship with traditional financial systems.

Press Release Details

DUBAI, UAE, Nov. 7, 2025 /PRNewswire/ -- Bybit, the world's second-largest cryptocurrency exchange by trading volume, has released its latest Bybit TradFi Report. The report explores how investors are assessing labor market conditions amid the ongoing U.S. government shutdown, focusing on how private data is being used to fill the gap left by suspended official statistics.

Key Highlights:

-

Private Compiled Data: With U.S. labor statistics halted during the government shutdown, private data sources such as Bloomberg's reconstructed unemployment figures show a modest decline in initial jobless claims, suggesting tentative stabilization.

-

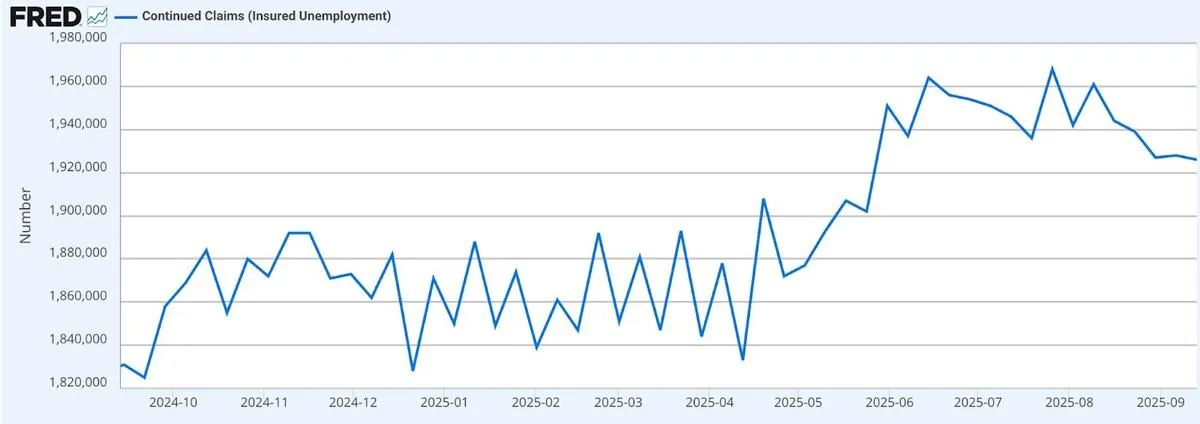

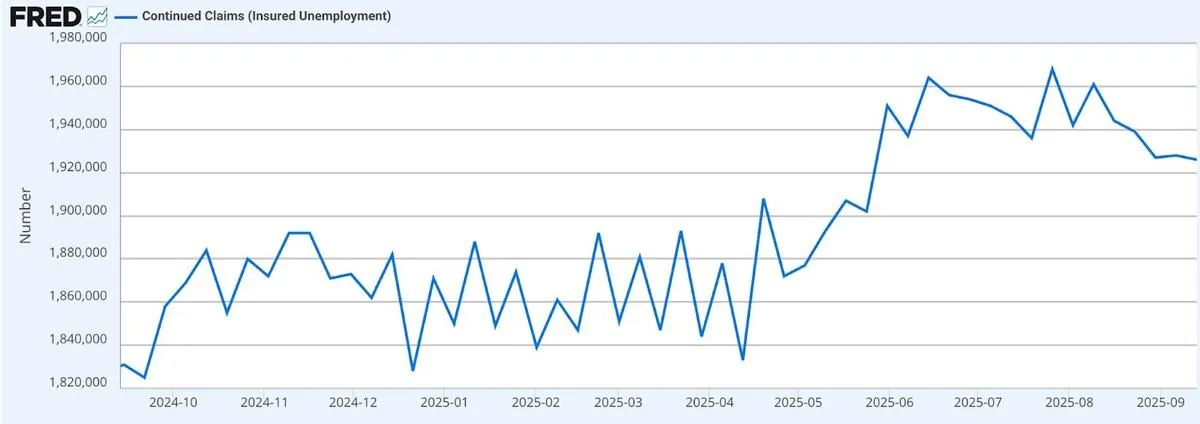

Continuing Claims: Benefit claims have edged higher to 1.95 million, indicating slower workforce re-entry and highlighting the continued strain on federal employees.

- ADP, Job Postings, and Wage Trends: Private-sector employment data and online job postings point to renewed hiring momentum, while wage trends and consumer sentiment offer additional insight into labor market resilience.

The report highlights that market participants have turned to alternative indicators such as Bloomberg's reconstructed unemployment statistics and ADP's newly introduced weekly payroll data to gauge labor market health. Bloomberg's analysis estimates that initial jobless claims fell to around 218,000 for the week ending October 25, down from 231,000 the previous week. While this suggests gradual improvement, gaps in state-level reporting introduce some uncertainty.

Continuing claims have risen slightly to 1.95 million, signaling that re-entry into the workforce remains slow. Federal employees are disproportionately affected, with unemployment claims under the federal program reaching their highest level since the previous shutdown. Meanwhile, ADP's private-sector data shows steady job creation, averaging 14,250 new positions per week—a rebound from September's job losses. Market sentiment points toward stabilization, though persistent benefit claims and limited hiring momentum underline the economy's fragility.

The full analysis is available in the Bybit TradFi Report.

#Bybit / #CryptoArk /#BybitResearch / #BybitLearn

About Bybit

Bybit is the world's second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit's Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube