Trump Drops $400-Billion Dividend Bombshell For Americans — Crypto Market Erupts

📋 Article Summary

Related Articles

Asia Morning Briefing: Hong Kong's FinTech Week Belonged to Stablecoins, Not CBDCs

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.Six years after China's eCNY debut, Hong Kong's FinTech Week showed how the digital money narrative has shifted to stablecoins, as Brazil's Drex pivot (the country's own CBDC project) underscored waning momentum for central bank projects.

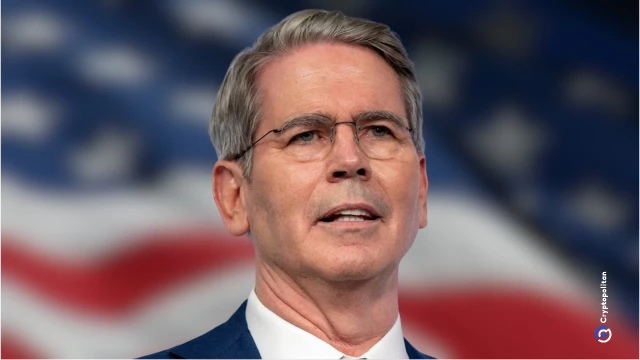

Senators introduce bill to move crypto market regulation from SEC to CFTC

Shifting crypto regulation to the CFTC could streamline oversight, foster innovation, and enhance consumer protection in the digital market. Senators introduce bill to move crypto market regulation from SEC to CFTC.

US Treasury and IRS Clear Path for Crypto ETPs to Stake Digital Assets and Share Rewards

Groundbreaking U.S. tax reforms are unlocking a new era for crypto investment trusts, granting them the power to stake digital assets under a protected federal framework while preserving their vital tax classification status. IRS and Treasury Establish Clear Tax Path for Digital Asset Staking The U.S.

Winklevoss brothers' Gemini logs $159.5 million loss in Q3 as spending surges, stock crashes

Gemini Space Station, the crypto exchange founded by Tyler and Cameron Winklevoss, on Monday reported a bigger net loss than analysts anticipated in its first earnings release since going public. The company posted a loss of $6.67 per share, compared with the $3.24 loss expected by analysts surveyed by Bloomberg.

Biotech firm Propanc secures $100m for digital asset acquisition

Propanc Biopharma, a Nasdaq-listed biotech firm, has secured up to $100 million to bolster its digital asset strategy.

US to allow crypto ETPs stake and share crypto rewards with retail investors

The U.S. Department of the Treasury and the Internal Revenue Service (IRS) have released new regulatory guidance that explicitly permits cryptocurrency exchange-traded products (ETPs) to stake underlying digital assets and distribute the resulting staking rewards directly to retail investors.