This Week's US Economic Events Include Fed Decision, Earnings, and Crypto Bill

📋 Article Summary

Related Articles

US Treasury and IRS Clear Path for Crypto ETPs to Stake Digital Assets and Share Rewards

Groundbreaking U.S. tax reforms are unlocking a new era for crypto investment trusts, granting them the power to stake digital assets under a protected federal framework while preserving their vital tax classification status. IRS and Treasury Establish Clear Tax Path for Digital Asset Staking The U.S.

Winklevoss brothers' Gemini logs $159.5 million loss in Q3 as spending surges, stock crashes

Gemini Space Station, the crypto exchange founded by Tyler and Cameron Winklevoss, on Monday reported a bigger net loss than analysts anticipated in its first earnings release since going public. The company posted a loss of $6.67 per share, compared with the $3.24 loss expected by analysts surveyed by Bloomberg.

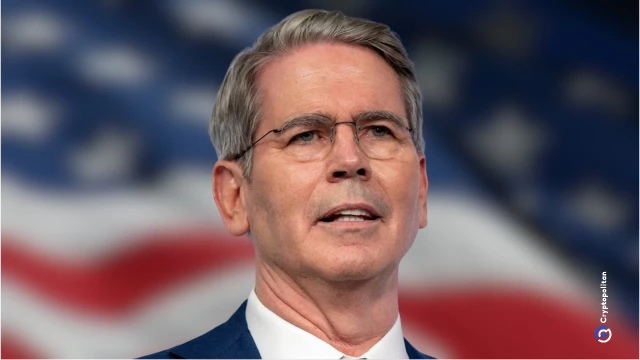

Trump Drops $400-Billion Dividend Bombshell For Americans — Crypto Market Erupts

US President Donald Trump's latest promise of a tariff-funded “dividend” sent shockwaves through markets Monday, and traders in digital assets moved quickly to price in the possibility of extra cash in American pockets. Related Reading: Trump's Bitcoin Bet Grows: American Bitcoin Now Holds Over 4,000 BTC The plan would pay at least $2,000 to most adults and has been described as part of a broader push to use tariff receipts for direct payments.

Biotech firm Propanc secures $100m for digital asset acquisition

Propanc Biopharma, a Nasdaq-listed biotech firm, has secured up to $100 million to bolster its digital asset strategy.

US to allow crypto ETPs stake and share crypto rewards with retail investors

The U.S. Department of the Treasury and the Internal Revenue Service (IRS) have released new regulatory guidance that explicitly permits cryptocurrency exchange-traded products (ETPs) to stake underlying digital assets and distribute the resulting staking rewards directly to retail investors.

eToro stock surges on strong Q3 results and $150M buyback

eToro's stock rises following their Q3 results and a plan to buy back $150 million shares.