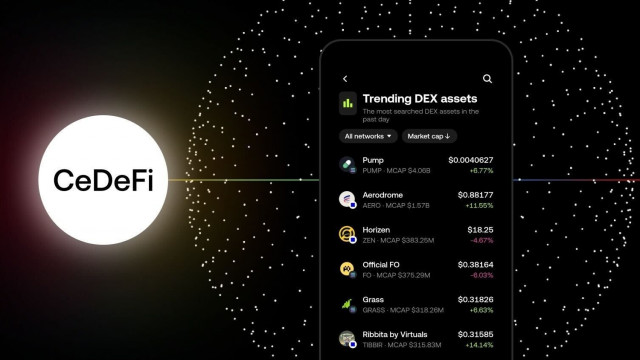

OKX Launches CeDeFi Trading, Bridging Centralized and Decentralized Markets

📋 Article Summary

Related Articles

BNY Mellon Launches Stablecoin Reserves Fund, Expanding Wall Street's Digital Asset Play

TL;DR The Bank of New York Mellon launched the BNY Dreyfus Stablecoin Reserves Fund (BSRXX), a money market fund for stablecoin issuers seeking to comply with the GENIUS Act. The fund invests in high-quality securities with maturities of up to 93 days, allowing issuers to manage liquidity from new token issuances.

Tokenization Platform Libeara Partners With GFX to Drive Pan-African Financial Inclusion

Ghana's GFX has partnered with Libeara to bring tokenised government bonds on-chain, cutting costs and opening smaller tickets to local savers, while the Bank of Ghana develops a VASP framework and broader crypto regulations for a supervised market.

South Korea's Push for Secure Stablecoins Aims to Rival U.S. and Japan

TL;DR FSC Chair Lee Eok-won urges balancing financial safety with international competitiveness. The government aims to allow private firms to issue won-pegged coins, reversing previous bans. Lawmakers criticize the Bank of Korea's caution in a global market that now exceeds $305 billion. The global race for dominance in digital financial infrastructure is intensifying in Asia.

Bitfarms stock tumbles as miner posts $46 million loss, plans AI/HPC pivot with Washington site

Bitfarms reported revenue of $69 million, which was up 156% year over year but missed most estimates by around 15%.

Grayscale's NYSE IPO Bid Marks New Chapter in U.S. Crypto Market Expansion

TL;DR Grayscale Investments has officially filed for an IPO to list its Class A shares on the NYSE under the ticker GRAY, signaling stronger crypto integration into U.S. capital markets. The firm manages around $35 billion in assets and sees a $365 billion addressable market.

Solana-Focused Upexi Approves $50M Share Buyback as Digital Asset Treasuries Turn to Repurchases

Upexi (UPXI), a Nasdaq-listed digital asset treasury firm focused on Solana SOL$152.37, said Thursday its board has approved to buy back up to $50 million of its own stock.