Crypto Market Flips Script As Order-Flow Manipulation Reshapes Trading: Expert

📋 Article Summary

Related Articles

Top 5 Crypto Lending Platforms in 2025: Where to Lend and Borrow Smarter

Compare the top crypto lending platforms of 2025 for rates, regulation, and risk to lend or borrow wisely.

Crypto VC Funding: Lighter leads with $68m investment, Kyuzo's Friends bags $11m

The week of November 9-15, 2025, recorded $122.35 million in crypto funding across 10 projects. As per the data, Lighter's $68 million raise led the last week's funding period that featured derivatives platforms, gaming ventures, and infrastructure development.

Crypto CEO Sentenced To 5 Years For $9M Ponzi Scheme, DOJ Confirms

The US Department of Justice (DOJ) has brought to light a new digital asset fraud scheme, culminating in the sentencing of a crypto CEO to almost five years in prison. Travis Ford, the CEO, co-founder, and head trader of Wolf Capital Crypto Trading, was found guilty of orchestrating a crypto investment fraud conspiracy.

Investors Are Embracing New Strategies in the Evolving Crypto Market

On November 15, 2025, the cryptocurrency landscape is undergoing a dramatic shift. Traditional strategies like purchasing digital assets during market downturns are being reevaluated.

Wolf Capital CEO Sentenced To Five Years In Crypto Fraud Scheme

Travis Ford, the CEO of Wolf Capital Crypto Trading LLC, was sentenced to five years in prison for leading a $9.4 million crypto investment fraud scheme.

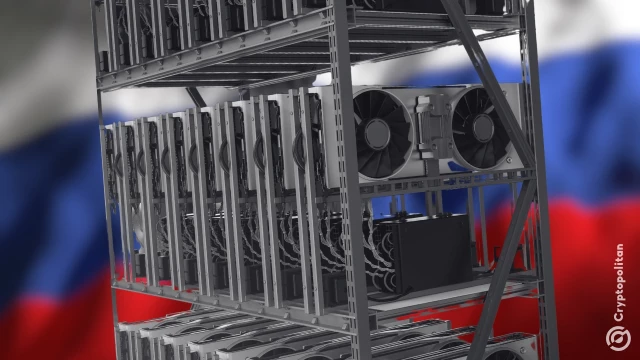

Russia enforces winter bans on crypto miners in Buryatia and Transbaikal

Russia is reinstating a ban on cryptocurrency mining in two of its regions in Siberia, which will remain in place until the spring. The restrictions are aimed at avoiding electricity shortages in the territories during times of peak consumption in the cold winter.