India Officially Recognizes Crypto as Legal Property Assets

📋 Article Summary

Related Articles

Crypto Wrap: ‘OG' Whale Dumping and US Investor Flight Blamed for Crypto's $260 Billion Contraction

Bitcoin fell below the $100,000 mark twice in a turbulent week, losing nearly 8% and dragging the broader crypto market down by over $260 billion to a $3.51 trillion valuation.

Cryptocurrency Markets Could Stabilize with NYSE-Style Regulations, Economist Suggests

On November 6, economist Alex Krüger proposed a transformative approach to managing cryptocurrency markets, suggesting they adopt regulations similar to those of the New York Stock Exchange (NYSE) to combat severe downturns in digital asset values. His assertion highlights the current vulnerability of the crypto market to significant price drops due to the absence of regulated market makers who are instrumental in maintaining liquidity.

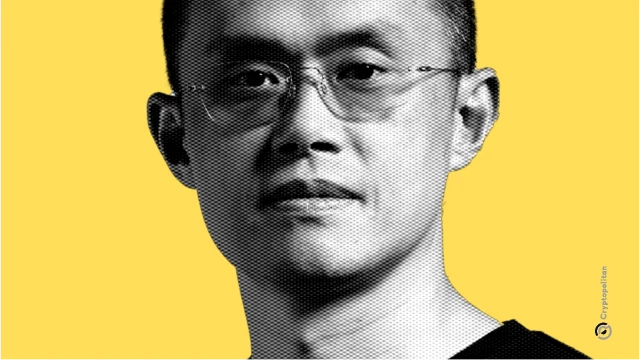

CZ says he was surprised by pardon, denies ties to the Trump family

Binance co-founder CZ pushed back against allegations that his pardon was motivated by close ties or business deals with the Trump family.

CZ says Trump's pardon was unexpected and not linked to any personal or business connection

Changpeng Zhao, known as CZ, said his recent presidential pardon “came out of nowhere,” and denied there was any business arrangement tied to it, according to a Fox News interview where he spoke for the first time since the pardon.

Convicted FTX Founder Tries to Rewrite History Again: Critics Instantly Tear Him Apart

SBF is again claiming FTX was never insolvent, even as appeals judges this week showed zero interest in tossing out his fraud conviction.

Wintermute Report Flags Deceleration in Crypto's 3 Key Liquidity Channels

Despite supportive global liquidity and easing central banks, Wintermute's Jasper De Maere says crypto has entered a self-funded phase—where money now circulates internally instead of expanding the market.