Tom Lee: Stablecoins Could Be Largest Buyers of Gold

Tom Lee: Stablecoins Could Be Largest Buyers of Gold

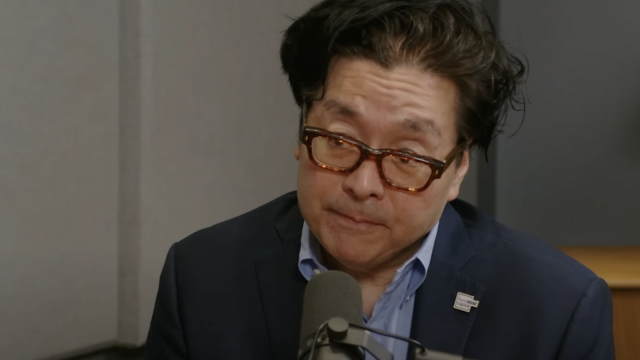

During a recent appearance on CNBC, Tom Lee floated an interesting theory about the strongest gold rally since 1979, suggesting that stablecoins could be behind it.

Article Summary

**Tom Lee Links Stablecoins to Gold's Historic Rally: Cryptocurrency Market Analysis** Fundstrat's Tom Lee presents a groundbreaking theory connecting the cryptocurrency ecosystem to gold's strongest performance since 1979. During his CNBC appearance, Lee suggested that stablecoins could be the driving force behind gold's remarkable rally, highlighting an unexpected intersection between digital assets and precious metals markets. This analysis reveals how blockchain-based stablecoins, which maintain value pegs to fiat currencies, may be significantly impacting traditional commodity markets. The connection between cryptocurrency infrastructure and gold purchasing represents a paradigm shift in how DeFi protocols and digital asset managers approach portfolio diversification. Lee's insights underscore the growing influence of cryptocurrency markets on traditional financial instruments. As Bitcoin and other digital currencies mature, stablecoin issuers are increasingly seeking gold-backed reserves to strengthen their asset foundations. This trend signals deeper integration between cryptocurrency markets and conventional investment vehicles. The theory positions stablecoins as unexpected institutional players in precious metals markets, potentially explaining gold's exceptional performance. For cryptocurrency investors and traditional traders alike, this development highlights the evolving relationship between digital assets, blockchain technology, and established commodity markets, creating new opportunities for portfolio optimization.

![Humanity [H] Cryptocurrency Leaps to Record $0.39: Can This Momentum Last](https://crypto.snapi.dev/images/v1/y/e/4/gen35-514418-803220.jpg)